Instead, they work with a bank that lends them the money, which is then loaned to you. In most cases, the company will not issue you a loan using their own capital. Most companies require you to use their services in order to get a tax refund advance, which can be a disadvantage if the service price is more than your refund loan amount. To get an advance on your tax return, it’s best to use tax preparation services to ensure you file properly. It’s always better to use a tax preparation service to avoid this error, but if your return is denied, you could have a hefty loan looming over you and find yourself in the need of tax resolution

#Turbotax advance refund reviews professional

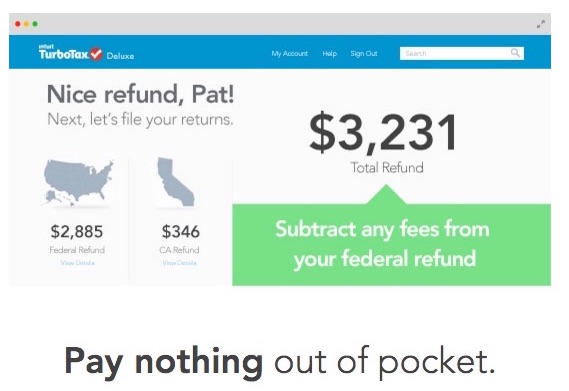

It’s advised to consult with a professional to answer any tax refund questions you have and to properly fill out your return.Īdvantages and disadvantages of a tax refund advance Tax preparers look at how much you’re expected to receive from your tax refund and base the loan on your projected refund amount. You get this loan before the IRS actually processes your return. It’s important to remember that a tax refund advance is a short-term loan against your income tax refund. However, with a tax refund advance, you can get a portion of your refund in as little as 24 hours. When you normally file your tax return, it will take around 21 days for you to receive your refund in the form of a check by mail or direct deposit from the IRS. Advantages and disadvantages of a tax refund advanceĪ tax advance loan is when a tax preparer loans you a portion of your tax return in advance.This is an easy way to get your refund as soon as possible, but, there are a few things you should know before you get an advance on your tax return. Some people can’t wait to get that money returned to them and consider taking out a tax refund advance. Sure, filing taxes can be time-consuming and confusing, but if you get the right help, tax season can feel more like Christmas morning! Finding out that you’re owed a sizable refund, or discovering new tax credits that put more money in your pocket, is oh-so-sweet.

But there’s no need to be stressed, worried, or anxious. Many people get excited about tax season just like they do when it’s time to visit the dentist.

0 kommentar(er)

0 kommentar(er)